Is filing a UCC commercial lien a good way to enforce rights?

What are commercial liens?

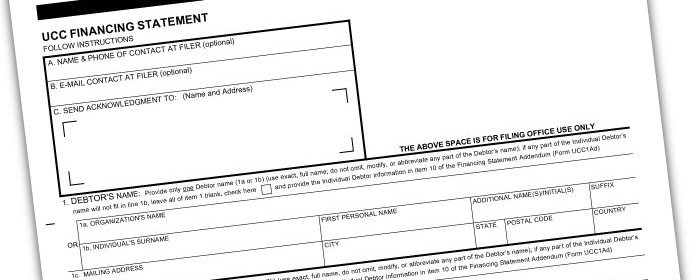

The term "commercial lien", or just "lien", loosely refers to the filing of a UCC-1 financing statement under the laws of UCC Article 9 in a state registry as notice of an interest in some collateral. You might be familiar with such liens if you've ever financed a car or other property. The financing statement lists the name of the secured party and debtor and includes a description of the collateral, or simply refers to an object directly by serial number or other identifier, such as the Vehicle Identification Number found on most automobiles.

The filing of the financing statement does not, by itself, establish a valid, enforceable lien, but is merely a reference that indicates there might be a possible valid lien. The actual legal right to enforce a lien arises from a contract called a security agreement between the secured party and the debtor. A security agreement must be consensual, in writing, the collateral should be listed, the intent of the debtor to grant a security interest should be clear, and it must be signed by the debtor pursuant to the statute of frauds established by UCC 9-203(b)(3)(A) and the definition of "authenticate" in 9-102(a)(7).

Popularity with sovereign citizens

Once filed, whether there's a valid security agreement behind it or not, a financing statement serves as a warning to the public and potential creditors that there may be money or property owed by a debtor. This is likely to seriously affect the debtor's ability to obtain credit, especially when it appears a significant value is owed.

Unfortunately, in the interest of expedient commerce, the process is open to abuse. The legitimacy of a security agreement is not verified by state UCC offices before a financing statement is allowed to be filed. As a result, these instruments have become popular with sovereign-citizen types who use them to try to get revenge or obtain compensation for perceived trespasses against them.

The typical abusive process

To lend legitimacy, the would-be sovereign typically sends a series of letters by certified or registered mail outlining the perceived breach of their rights and giving the target an opportunity to pay an arbitrary amount as compensation. They might do something like this, for example:

- Notice of fault

- Second notice

- Default

- Invoice

- Lien (Financing Statement)

Paper terrorism

Abusing UCC-1 financing statements is often labeled paper terrorism. As we've covered, it's a relatively easy way to cause significant frustration and harm to a party. To remove a false filing the debtor must bring a lawsuit against the secured party claiming there is no valid security agreement. Once the court sees the debtor did not explicitly grant a security interest in writing the court will order that the financing statement be discharged, and may further order costs and damages be paid to the victim. While straightforward, this is not always easy to accomplish as it can require significant expense and time to achieve. Furthermore, many people who abuse the system do so because they are broke, desperate and have nothing to lose, so it may not be possible to actually collect on any award for costs or damages.

Laws against false liens, and punishments

Georgia was one of the first states to enact a law to combat the scourge of false liens with a statute that mandated 1 to 10 years in jail and up to a $10,000 fine for each false lien against a public official. This was later extended to all persons. Various other states have laws to help combat fraudulent liens. Federal laws are also available, such as 18 USC § 1521 and 18 USC § 287.

A number of people have been criminally charged and sentenced for filing false liens:

- Cherron Marie Phillips – 7 years jail (Memorandum)

- Tyrone Eugene Jordan – 10 years jail (Docket)

- Donna M. Kozak – 3 years jail (Judgment)

- Randall David Due – 10 years jail (Judgment)

- David Carroll Stephenson – 10 years jail (Judgment)

- … and many more

Conclusion

Playing with commercial liens can have serious consequences. Unless you know what you're doing and have a legitimate security agreement signed by the debtor you should avoid filing UCC-1 financing statements.

What do you think?

Those Sovereign Citizens have it all wrong about the UCC. They think that it's a replacement of the Constitution that, along with the abandonment of the gold standard, turned the U.S. into a corporate-owned nation where the people are "enslaved" through anything that those Sovereign bozos believe would entail an implicit contract, such as birth certificates, vehicle registrations, insurance cards, those kinds of things.

Fact is, the UCC is a subset of law relating to commerce, and is COMPLETELY uninvolved with civil or criminal law against individuals.

Now, I never registered to be a voter, because one may never know who's honest or who's an ambitious and corrupt scumbag. Now, I may not have much faith in the U.S. government at large, but it's no reason for me to buy into any of the BS that the self-proclaimed legal "gurus" propagate throughout the Internet.

Are you fucking retarded? You just read how the system does this to you on a daily basis, believe it, and think you have no remedy? Wow!! It is separated from the constitution because only public officials sign the constitution by taking oath. Now they are bound to follow those rules, which protect us, but that contract isn't the only rights you have as a human. You people are giving the government more and more power. Wanna know why we lost our gold? BECAUSE WE MADE A FUCKING DEAL WITH THE GOVERNMENT. I'm not explaining anything further to a generation that covered hardwood floors with linoleum tiling. Go fuck yourself.

especially when the sovereigns are the police nd other govt. types . get it right fool .

Really ? The Constitution! Which one are you referring to. There are 3 . You as smart as you’re presenting yourself to be , I am sure you know that. By the way, you may want to look up the word “ Constitutor.”

You also might want brush up on history and mix a little bit of common sense in there. I suggest engaging your common sense first, jn order to be able to use it.

After you do that I think it would be very beneficial to look at that time period in history as to all the events that happened, around the making of the

“ CONSTITUTION.” ( of course keeping in mind what a constitutor is)

Also you might want to learn the language and definitions of words used by the government in their bills, statues etc. Quite interesting how the words we use every day and their definitions, don’t have the same meaning when uses by our government when they create statues, bills etc.

interesting don’t you think? Almost like it was dine purposely that when

normal everyday “ citizen”

( not what you think citizen means) but anyhoo is signing important documents like lets say having to do with real estate, like lets see…oh like buying a house.

stop trying to scare people from using liens.. they are a legitimate tool when you are owed something.

The correct way to enforce a bill, contract, etc. is to file a lawsuit, get a judgment, and use court orders to seize income and assets. Liens are typically for collateralized obligations and, as stated in the article, require a security agreement (contract) signed by the debtor. Seizing an alleged debtor's property without a court order or valid security agreement is contrary to law. What makes you think otherwise?

@pseudolaw:disqus Hopefully, this chap isn't a sovereign citizen like certain other people on the internet that commented here on your site to try and discredit you.

Title 38 USC 3002, corporation…contract is law…end of story.

Title28

Pursuant to the Statue of Frauds, I have learned that certain types of contracts must be in writing to be enforced. However, promissory estoppel which is what I am alleging in my lawsuit against the fraudulent seller, says we had/have an enforceable contract, although it was predominantly ORAL. So that is why I want to do a commercial lien, because I ONLY ever invested substantial money and time because the offer on the table BEFORE I invested, was for the purchase via 3 year lease option. The seller ( an active licensed real estate broker) knew she was required to give me a written contract because the lease was for greater than a year, and or, my investment was for greater than $5000.00. My fraudulent landlord-real estate broker, knew this. So I have also alleged fraud. She took me to eviction court on June 30, 2017, and lost! Now she's calling me a "tenant at will" since the judge through out, that made-up 10 months post-possession contract…the jury did not believe her, and they also thought I was insane for doing such a deal without a written contract. Well, in eviction court, there is a very small amount of evidence allowed in, so there was a lot they did not see, which are email, text, and other letters that indicated what this deal was. I also recorded conversations with the seller, out of fear she was about to pull one over on me. I told this to the jury and judge at the eviction court, and he said that I broke the law by recording her. but I looked up the law in California a "two party consent" state however, federal law trumps state, and it says "one party" consent, that being me. I learned all of this after I recorded, and after, the judge told me I broke the law if I recorded without her consent. I just needed to get some leverage and truth documented so in an instant, I just recorded all conversation, and they tell the story of what the deal was. I am a pro se litigant, and I am terrified, looking for help where I can get it, my corrupt landlord makes over $60,000 per month, she owns two group homes, and can afford the most expensive attorney. I am broke and cannot at this time. So I am looking for help where I can get it. I am not trying to be corrupt, just desperate

Listen if she is a Realtor, then all her transactions must be in line with the laws that govern real estate transactions and their code of ethics Also that's fraud/breach of trust which also falls under USC title 15.

That's right! it is fraud and breach of contract/trust. My lawsuit filed in July 2017, alleges that. I am a pro se litigant, and her attorney ask the court to demurrer my complaint for lack of clarity regarding cause of action, using wrong sized font, and using 32-line pleading paper, instead of the required 28 line pleading paper. Snake! The judge sustained the demurrer, however, PRAISE GOD!!! She wrote up a 7 page letter stating that ALL my causes of actions were sustained, however, I did NOT plead "promissory estoppel" sufficiently. So this wonderful judge in that 7 page document, she did it for me. The judge also noted in a lengthy paragraph, how she has taken notice that they DID NOT ADDRESS the allegation of FRAUD AND BREACH OF CONTRACT…It was wonderful to hear her comments, that I will use as a road map to amend my complaint.

That's what a magistrate is supposed to do!!! I have a question for you… Whats your nationality/Status?

"You got some 'splaining to do'" (Ricky Ricardo voice, from the "I Love Lucy" show) with that question. I can only answer you like this. I am an American Hustler. I am Cardiothoracic ICU RN-(recovering open heart surgery patients for over 10 years) as well, I am an Acute Care Adult Gerontology Nurse Practitioner, with a Masters Degree, and was headed to Emory University for a PHD program this fall. Dated a ten year veteran of the NFL, for 27 years, with whom we share a daughter, 29-nearing the completion of a Law Degree, and granddaughter,10. No dummy WHATSOEVER!!! I was blind, impulsive, hoodwinked by a criminal, and I did a poor job crossing my t's and dotting my i's. I also have very limited experience dealing with the courts and its proceedings to know what a Judge is supposed to do, or not do. Those are my stats!

The commercial lien, is in form of an affidavit. There is nothing harder to overcome than an Affidavit in Law properly enforced.

Commercial liens are based on security agreements, which are voluntary contracts. Mere unilateral affidavits do not establish an obligation of the recipient unless dictated by some judicial process, legislation or prior contractual agreement.

Sorry, I forget your not a National, or Sovereign. We are both right, but from different stand points. You as a citizen subject people of the United States and the British Crown, and us as Cestui Que Trust owner and beneficiaries!!!

You have reached peak stupidity. Goodbye.

Oral agreements are enforceable, and I would not dare wait until my case is heard before I act to protect my interest. The property will be sold by then, and all her assets transferred elsewhere. SO while it may seem unlawful and unenforceable to you, it is effective for people like me, looking for a temporary injunction, while waiting on the courts. If the courts decide I am owned nothing, that's fine. But until then, I want my interest protected so I will do what I need to do by placing an involuntary lien on her property, that she must go to court to have removed. But of course that will not happen in her case because of the evidence and her fraudulent unlawful conduct and behavior.

I read that you can legally remove a lien though by 1.) most obvious paying it off but also 2.) requesting that your lender files a UCC-3. How effective is this typically? Source: http://fitsmallbusiness.com/what-is-a-ucc-filing-lien/#remove

Read carefully.. the lender can be asked to file a UCC-3 to remove the lien after it's paid. This has nothing to do with the paper terrorism mentioned in the article, and you can't use it to get out of a legitimate security agreement and lien without paying (unless the lender happens to voluntarily forgive the debt).

May I use this process if someone gave me an oral agreement to sell property for 625,000, then presented me with a purchase offer. After I received the purchase offer, I invested nearly $100,000 in capital improvement change of use from retail to commercial restaurant. The market in the area went up, instead of selling it to me, she tried to evict me stating that i did not pay rent, but lost the case in eviction court on june 30th, 2017. Now she is calling me a "tenant at will", when at the end of the "fixturing period", she agreed to give me a 3-year lease with option to purchase minus the capital improvement investment( to reflect the actual money I invested). Instead (of getting the "carrot") she-the seller (who is also a licensed real estate broker) placed the property on the market for 725,000, 11 months after she gave me the purchase offer. I have filed a civil case on july 31, 2017, but I want to also do this commercial lien, to stop the sell, or if she sells before our case management conference on Dec 13, 2017, subsequently, the case is heard, I want to have some leverage to slow her down and get my money returned plus punitive damages. I am so desperate for justice, this has been a tremendous nightmare, topped off by the fact that I never got the chance to open my storefront because of all the moving parts, side issues, and legal maneuvering intentionally created by my fraudulent 77-year old landlord.

Tell me, did you sign a contract with the women about the lease. Does the owner of the owner of the building know what she is doing? Did you hire your own Realtor, or do you have her under contract? If you signed a contract with her to work for you, it's a breach of trust!!! I don't know all info, but heading shad you've said this far, that would be my argument!

The fraudulent women is the owner/landlord…who is also the realtor-broker! Some of this transaction is in writing (emails, text, signed agreement to secure permit for work on storefront), but the contract was not signed because she kept saying, "I'm going to give you credit off your capital improvement expenses by deducting it off the purchase price" she kept me thinking, all the expenses had to be known before we put the contract together. I know better now, but she's a fraud, and a crook. The contract was also not signed because she presented me with a "residential purchase agreement" for "mixed use commercial". The contract she presented to me, before the work was done, was fake, that I did not know at that time. Then she went on with…lets wait until the work is done, so my capital investments can be deducted off the purchase price. My prayer, the courts will see her for what she is!

The owner of this site is an agent whose entire purpose is to subject people to 14th amendment status when that is optional. I already know by you using the term "sovereign citizen" that you are an agent. One cannot be both a sovereign and a citizen.

No, a UCC-1 aka commercial lien is typically used to secure collateral for a debt and requires the written agreement and consent of the debtor. Perhaps an application to a court could achieve an injunction preventing a sale based on a breach of contract or other.

Thank you. There is a hearing for tomorrow for injunctive relief preventing the sale of the property until my case against her for fraud and breach of contract/trust is heard before the court, and determined, since one of the remedies I am seeking, is for the courts to enforce the sale of the property. Also, yes, I qualify to file an artisan/mechanics lien with county recorders office. Its already in process. The County Recorders office, will then notify her than an involuntary lien has been placed against the property in discussion. I don't care about that. I just want my money, if she sales before I can stop it. Thanks for the information

a common law lien would work as well to at least get back your investment!!!

The contract is the Constitution. The signature is on the oath justice department employees take.

The Constitution says the courts are in charge of interpreting the law, so why inject your own theories instead of asking the court to do its job and respecting its authority? If you want the law to change you need to influence the people in your city, county, state, country to participate in public polling, etc. to influence your representatives in the legislature(s).

Or the Lawful Owners of this continent can force them with threat of death for treason!!! Not to mention numerous International Human Rights violations.

Unless you can defeat the constitutional military and police you can easily go to prison for such threats. International law says states are sovereign within their territory, and there's a non-intervention principle, so it doesn't really apply. Even with millions of people on board, notice how no country is supporting any lawful right of Catalonia to leave Spain and they call it an internal matter?

Unless you can defeat the constitutional military and police you can easily go to prison for such threats. International law says states are sovereign within their territory, and there's a non-intervention principle, so it doesn't really apply. That's why even with millions of people on board no country supports any lawful right of Catalonia to leave Spain and it's considered an internal matter.

The state uses misapplication of the law as standard procedure. If a citizen tries it they are treated as fools and deadbeats.

If anyone misapplies the law there can be consequences. The courts, pursuant to the state or federal constitution, are in charge of interpreting the law, though, not individuals.

I have every right to interpret law.

You can interpret it how you like, but federal, state, county, municipal executive officers follow the decisions of the courts, as created and empowered by their respective constitutions.

As if that means anything. I could care less about the opinions of any corporate officer.

Acting contrary to the government's laws can lead to being charged, restricted, imprisoned, etc. You might find life a lot easier and more enjoyable if you learn to use them for your benefit.

To put your comment in perspective. I can form a gang. Beat you up. Throw you in a cage, etc. But that doesn't mean that I acted under any form of law. The government is a corporation. A corporation is a group of people. A group of people with zero authority over me if I didn't voluntarily give it to them. Government does not have laws. Government has policy. You should learn the difference.

A corporation is an entity incorporated under a nation-state or sub-state. Nation-states are not considered corporations in any law on the planet. They are considered "bodies corporate", i.e. a unified entity with many members, yeah, but they aren't subject to any law [other than voluntary principles of public international law that other nation-states can try to hold them to], they're sovereign. Actual, enforceable law only occurs within nation-states. So-called natural law or God's law has no recognition or effect, they're just theories that vary and people make up as they go along. Law begins at each nation-states constitution. The constitutions are the highest laws on the planet. You can't "contract" in or out of a nation-state or sub-state because contract law actually begins and is defined within the state.

Thats hilarious! Look up constitutor!

only uu sovereigns are allowed to break law , right.

You need to really learn-what the constitution is! Look up what a constitutor is. Cross referencing y that w going on at the time. Get a clue!

do u mean the corrupt courts where a conflict of interest prevails . fukn traitor , get out of my country crook .

You can file a lien without using UCC. And someone needs to learn that you cannot use a "legal" process to sequester the law. A lien is only a false lien if the issuer of the lien lies on the paperwork. In a commercial lien, anything on the commercial affidavit BECOMES the truth if it goes unchallenged. That's how commercial law works.

You can't bind someone if they merely fail to respond – they actually have to clearly show intent to agree to your offer and create a legal obligation. If it weren't that way you could simply flood the world with offers and whoever didn't respond would be your slave. Much of contract law remains at common law, that is, in the decisions of state courts and not in legislation. One of the oldest cases on not being able to impose a requirement to respond is Felthouse v. Bindley. Numerous contract law books speak on the topic, too. The Canadian case Meads v Meads cites several such books in its "Unilateral Agreements" section at paragraph 447. A judge goes on at length about the "sponginess" of the maxim "silence is consent" in a case from PA, Commonwealth v. Dravecz, concluding "the tacit admission rule has no solid foundation whatsoever." Much or all of the US generally follows the Restatement (Second) of Contracts, which states when exactly a contract may be established by silence in section 69. A notable exception to contract law requirements is when a previous agreement, legislation or court rule dictates that a response must be given.

You obviously haven't researched how commercial law works. Or Commercial Affidavit Process. If you are injured by someone's actions, you have every right to bind them into a contract. For all intents and purposes, that's what a lawsuit is. CAP works the same way, but is a lot less expensive and a lot more efficient because it does not require a court. You seem to have a knack for not creating a complete picture. And a judges opinions might matter to a judge, but they don't have to matter to anyone else.

If you are injured you typically need to use state tort laws to recover damages. You can't ever simply arbitrarily bind someone into a contract of your choosing, especially not without their consent or intent to contract. The courts are created under the state and federal constitutions and the force of the state does in fact follow court decisions. That said, do any decisions support your claims? If not, you should reconsider.

I can see why the Ba'al priests posing as judges would call this paper terrorism. They are genuinely terrified of the public figuring out how full of shit they are.

Pingback: Field McConnell’s Flirtation With Paper Terrorism Tactics | Tracking The Leopard Meroz

The owner of this site is an agent whose entire purpose is to subject people to 14th amendment status when that is optional. I already know by you using the term "sovereign citizen" that you are an agent. One cannot be both a sovereign and a citizen. You should be ashamed of yourself.

All people and property within the internationally-recognized geographical area of the USA are automatically subject to federal, state, county and municipal law (where enacted). "Sovereign citizen" and "freeman-on-the-land" are umbrella-like terms used to describe people who think the laws don't apply to them. Of course, no government recognizes individual sovereignty as that wouldn't be government at all, but chaos.

You do a lot of espousing on this site but I discern that you have a very thin grasp of reality in relation to who the government really is and what its legitimate control of the people entails. If you really love law then perhaps you should start doing some serious investigative work which should improve your psuedo-thinking.

Thin grasp on reality?

You're the one who's relying on arguments which have failed time an time again.

Can you give a single case where a sovcit argument succeeded?

So are you a citizen?

How sovereign do you claim to be? If think the 14th doesn't apply to you, do you believe any of it applies to you?

I don't "claim" to be anything, I AM. What notice and claim can be made on me before I came into this world through my mother's womb?

Too bad for you that your parents chose to have you be born in whatever jurisdiction you're in that you cannot stand living within. I suppose you can blame Adam and Eve if you want, since they had to live under laws as well.

No need to be sorry. My passport has five stars 😁

Did I say I was sorry? I quite like having many of the laws we have, and try to change those I don't like.

You subject yourself to laws and statutes of each jurisdiction you travel to, including the one you were born in after you left it the first time (if you return) . So much for the mother's womb theory.

Statutes are not laws. They are codes for domestic chattle.

Lol, does a state have laws in your eyes, or only statutes? How do you recognize the difference?

All of the laws are in the Constitution of the state. You are confusing corporate taxes and fines for violations of statutes as laws. Legal and Lawful are not the same and are applied to individuals based on where they domicile. Btw, you can be born and raised in America and still be classified as "foreign".

Here's a better question: do you know the difference between a state and the corporate municipality masquerading as a state?

What about laws passed by representatives who were instructed to do so by their constituents via a State Question? For example: Oklahoma voters passed a state Question legalizing MMJ with certain things specifically spelled out but some of the regulations left to the legislature. Do you consider any/all/none of that law?

I care not about municipal corporations, AKA cities, I purposely live outside city limits to avoid additional ordinances. If people in my mile section choose to be annexed into the nearby city, I'll move just like I'd do if I found Oklahoma state laws/statutes unbearable.

Do you feel like the U.S. Constitution is law of the land? What about the Bill of Rights and also the 14A.

Truth Brother just truth thank you

Absolutely correct Indigo!! The 14th so-called Amendment: Any person born in the United States and subject to the jurisdiction thereof is a citizen of the United States. Use of the term 'person' is always indicative of reference to a legal fiction when used in ANY legal connotation. They are obviously referring to a legal fiction straw man estate because the United States is not a country but a federal corporation. Therefore, its impossible for any man of woman to be a U.S. citizen because a man cannot be born in a corporation. The only thing that can be born in a corporation is that which the corporation creates–the straw man estate.

This is flat out false, Person simply means a man or woman and not to any sort of legal fiction.

No it doesn’t!

THANK YOU FOR THIS! I am preparing to do this myself, now that I can PROVE that 'over 90 percent' of what police do IS 'to the Contrary' of 'the supreme Law of the Land', I have got at least 6 court cases against me dismissed, ANY harmless civil of criminal 'offense', I have had TWO COPS tell me that 'over 90 percent' of what they do DOES violate JUST FOUR of these 'FundamentalPrinciples' I have put together in these 'LawDocs' (Get them FREE from the 'Pinned Post' on 'GovernPublicServants' Facebook page), AND HERE IS A LINK TO THE POST WHERE I AM PREPARING TO BEGIN PLACING LIENS ON JUDGES FOR VIOLATING THESE 'FundamentalPrinciples' OF 'the supreme Law of the Land', WHICH NO LAWYER OR JUDGE HAS BEEN ABLE TO PROVE ME WRONG ABOUT IN COURT FOR ABOUT THREE YEARS NOW!

Every time I check, I am further CERTAIN, that I am ahead of every other person on Earth now, in learning how to ACTUALLY 'Fix' 'Government'!

So here is the link to that post, so everyone else can follow in my success, and PROVE that 'over 90 percent' of the Laws in the U.S. are 'In legal contemplation as inoperative as though it had never been passed.'!…

https://www.facebook.com/notes/harley-borgais/notice-of-claim-for-deprivation-of-rights-under-color-of-law-in-over-90-percent-/10210811804691310/?comment_id=10211508378425218&comment_tracking=%7B%22tn%22%3A%22R%22%7D

SO WHOSE WITH ME? WHO WANTS TO LEARN TO USE COMMERCIAL LIENS TO ACTUALLY 'GovernPublicServants' #LIKEaSOVEREIGN WITH ME?

Here is the FIRST (of MANY) times I made a cop stop even trying to give me 'Civil Citations', AND THANK ME FOR IT TOO!…

https://www.youtube.com/watch?v=b4SZvDLiOw0&fbclid=IwAR3alRTvYmFu-70iFEAlqBekyFeK9Rp7q6ixClt-gHDqxQGujgBIqO7GRaI

Only a FOOL would pass up all this FREE information, and ACTUAL Solutions!

They have The right to "travel"? Sure they can go "travel" just make sure they use a flying saucer just like George Jetson.

It is my opinion that all of These "Sovereign Citizen" are idiot narcissists who think that they can never do wrong and when they are caught doing wrong or even something that is illegal then they will play out their "sc" rights card "and they try to dismiss "every thing" that makes them responsible for their actions.

They want to live and do every thing that they want to do and they want it all completely free with no responsibility.

I bet that A large majority of the them have a background history of criminal activity and or past full of financial debt that their running or they are hiding from.

They are all a bunch of self centered hypocrites and I am going to type my next sentence in the way that these people twist and use their own word's or language

When they want to "travel" then They can stay off of every bit of "flat pavement" that my tax money pays for.

My friend you need to do your research before you run your mouth. Everyone who buys a gallon of gas pays taxes for the building and maintaining the roads. Not one penny of your income tax goes to do that, that tax money goes to the IMF to pay back the bailout. God gave us our freedom and liberties and God is the only one that can take them away or regulate them, not the government.

Yes yes yes

I do not believe anyone has a higher claim over my life, liberty, or my property than I do. Common law came from God's law. God's law covers everything. Man enacted his own law in order to control his neighbor. I do not claim to be sovereign and I am not a citizen. By the way, you can not be both.

Boy are all those sovereign citizens/freemen-on-the-land/moorish nationals/etc. coming out of the woodwork here in this comments section, huh?

I see now

I didn't read all the comments here but I can see that it is almost impossible to tell the difference between the trolls and the idiots who think [did I say think?] they know what they are talking about.

First of all, the term Sovereign Citizens is bandied about like it defines some lunatic fringe group thinking when, in actuality, it is an oxymoron. If one is Sovereign, he cannot be a citizen as a citizen owes allegiance to some higher civil authority.

The United States is not a country but a privately owned corporation that has pledged to provide governmental services to the people, however, that servicing appears to be likened to a bull servicing a cow.

The owners of the federal corp, the Rothschild/Vatican world mafia, took over this country after the Civil War, created their federal U.S. corp., then bankrupted it and to make it extremely profitable, created a whole lot of co-sureties on that bankruptcy.

Just how did they accomplish this feat? When you were born, a birth certificate was applied for. The BC was then signed by the Office of the Registrar. The Office of the Registrar is the Office of Probate which tends to the Estates of the dead. So here you are, just born and already you are declared 'deceased'. Deceased is the act of dying and everyone fits into that category.

They then create an estate and name it with a NAME similar to your own appellation, ie., name: JOHN WILLIAM JONES, vs. your appellation: John William Jones. Only legal fictions use the all caps NAME which is your straw man estate. That's why everything that comes to you from any government entity or corporate franchise always addresses the estate. The use of all capital letters is not proper English but is referred to as 'Glossa', the 'Justinian Deception', 'Dog Latin', and even more appropriate, 'the language of the dead'.

Those co-sureties mentioned above are those Govco created estates that they hooked on every man, woman and child without their knowledge and consent. Of course they're not going to tell you about all this because they want to keep you on the world plantation struggling to keep your head above water. Control is the name of their game. They fraudulently induced you to sign up to be the surety for the straw man they created when you signed on that 1st 1040 form where it said taxpayer signature—under penalty of perjury.

You weren't the Taxpayer but now they had a voluntary surety for that entity. Someone they manipulated into giving a worthless bunch of filthy rats a major part of your life's energy. You are paying for the government's bankruptcy like its actually your debt. Quite a clever scam isn't it?

Then there's that other little item that seems to evoke a lot non-thinking blather from those who have never investigated anything in their lives. Driving vs. traveling. If one checks out the federal definitions of driving you will notice that driving is described as a commercial activity–transporting goods or passengers for hire. Under the Motor Vehicle Compact the States Transportation Codes are required to be in line with the federal codes or the State cannot get highway funds from the feds. So how does the State comply? By merely leaving any mention of commercial activity out of their definitions. If the public found out the State would lose billions of dollars every year. The same thing is true about the term 'passenger'. A passenger is one who pays a fare to a 'driver' for being transported. Unless you have ridden in an Uber, bus, taxi, etc. most of you have rarely been a passenger and even far fewer of you have ever been a driver. I'm 81 and the last time I drove a motor vehicle was when I was 19 years old drove a wholesale ice cream truck.

As to laws that some of you 'thinkers' postulate that we should hunker down and preform under, let me give you a little heads up. There are only 2 concepts in "law" on this planet. The first one is that you cannot do harm to your neighbor. The second one is that you must perform in accordance with those lawful contracts you set your hand to. That one negates every presumed contract you have entered into with good old fraudulent Govco because every so-called government contract, whether presumptive or written is couched in fraud. Fraud vitiates all that it touches.

All these so-called laws known as Codes [they are called codes because they are written to be nearly intelligible to the average man], rules, statutes, ordinances, regulations, etc. are, in actuality, mere public policy under bankruptcy that do not apply to the living but are in place for their straw man estates. They get us into trouble when we don't recognize that they have conned us into the liability laden position of surety for their created debtor.

I'm sorry if I have offended anyone on this forum, but on the other hand, I am highly offended when those who know nothing, refuse to investigate and learn something, spout off with empty headed diatribe trying to impress others. If you intend to speak, how about doing a little research before you stick your foot in your mouth.